Bitcoin is increasingly being viewed as a potential safe haven for investors during times of uncertainty.

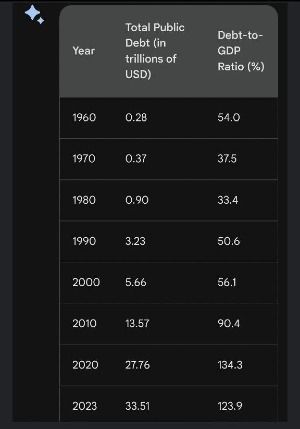

As the world faces more eopolitical tensions and uncertainty, many individuals are searching for strategies to safeguard their financial assets. Given the mounting levels of debt associated with fiat currencies, which are susceptible to both economic and political instabilities, Bitcoin is increasingly being viewed as a potential safe haven for investors during times of uncertainty.

Bitcoin is a decentralized digital currency that is not subject to government or financial institution control. This makes it an ideal asset for those who want to protect their money from the uncertainty associated with the current events taking place around the globe.

In addition, Bitcoin is scarce, with a fixed supply of 21 million coins. This scarcity makes it a valuable asset, especially in times of economic turmoil.

In recent months, we have seen a surge in demand for Bitcoin from countries that are facing economic uncertainty. For example, Russia has been mining Bitcoin at an unprecedented rate, and China has been dumping US stock and Treasury bonds.

This suggests that Bitcoin is being seen as a safe haven asset by investors around the world.

Of course, there are also risks associated with investing in Bitcoin. Bitcoin is a volatile asset, and its price can fluctuate wildly. Additionally, Bitcoin is still a relatively new asset, and its long-term viability is not yet certain.

Black Rock's Role

Black Rock is a global investment management firm with over $10 trillion in assets under management. It is one of the largest investors in Bitcoin, and it has been buying Bitcoin at a rapid pace in recent months.

Some experts believe that Black Rock is preparing for a future in which Bitcoin is the world's reserve currency. If this is the case, then Black Rock is likely to play a major role in the Bitcoin market.

However, other experts believe that Black Rock is simply diversifying its portfolio by investing in Bitcoin. Some argue that Black Rock is not necessarily bullish on Bitcoin, but it could be about gaining control of the market.

Only time will tell what Black Rock's true intentions are. However, it is clear that Black Rock is a major player in the Bitcoin market, and its actions will have a significant impact on the price of Bitcoin in the years to come.

Bitcoin Spot ETF

One factor to consider is the launch of the BlackRock Bitcoin ETF. This ETF, which is expected to launch in the near future, will allow investors to gain exposure to Bitcoin without having to buy and store it directly. This could make Bitcoin more accessible to a wider range of investors, and it could also boost the legitimacy of Bitcoin as an asset class.

Please note that as of October 24, 2023 the BlackRock Bitcoin ETF is still pending approval from the US Securities and Exchange Commission (SEC).